CRDF Global Hosts Training on the Development of Anti-Money Laundering Techniques for Cryptocurrency

To support the capacity of Indo-Pacific financial institutions’ ability to counter UN Security Council Resolution (UNSCR) sanctions evasion techniques, CRDF Global convened public sector compliance professionals from around the region for an in-person workshop in Manila, Philippines on May 7-8, 2024. With the generous support of Global Affairs Canada’s (GAC) Weapons Threat Reduction Program (WTRP), CRDF Global partnered with digital asset experts from Chainalysis to train 39 participants on cryptocurrency laundering risks. Topics included blockchain technology fundamentals, the utility of cryptocurrency, identifying risk typologies associated with illicit actors, and navigating the international cryptocurrency regulatory landscape. Participants gained a deeper understanding of the complex typologies and red flags associated with illicit actors and the various open-source research techniques available to assist them in identifying and responding to cryptocurrency laundering threats.

The event was attended by high-level representatives from the central banks, monetary authorities, and public agencies of the Maldives, Sri Lanka, Bhutan, Singapore, Indonesia, Mongolia, Vietnam, Philippines, and Nepal.

Workshop participants, partners, and subject matter experts

Limiting the Effect of Sanctioned Actors within the Indo-Pacific Region

As the financial sectors across the Indo-Pacific region work to adapt to international cryptocurrency obligations pursuant to the Financial Action Task Force (FATF) and UNSCR recommendations, updated guidance and information on illicit cryptocurrency proliferation finance tactics bolster the capacity of financial institutions to respond to risks they face. According to Chainalysis’ 2023 cryptocurrency report, the Indo-Pacific Region is a critical area for the future of cryptocurrency due to rapid grassroots adoption of digital assets and unique economic climate. However, this rapid adoption of crypto assets also increases vulnerability to attacks by illicit actors such as the DPRK and Iran. In recent years, malicious entities have reportedly stolen close to $1 billion USD from banks and digital financial institutions and continue to exploit weak or non-existent jurisdictions in the Indo-Pacific region. CRDF Global is responding to these threats and vulnerabilities by continuing to provide region-specific cryptocurrency workshops and guidance materials to central banks and financial regulatory supervisors that equip participants with the tools necessary to safeguard their jurisdictions from these vulnerabilities and threats.

Participants listen intently to the Chainalysis presentations.

Building Stronger Cryptocurrency Compliance Capabilities

To deliver a dynamic two-day in-person training, CRDF Global worked with digital assets experts at Chainalysis to build an impactful agenda that featured a variety of cryptocurrency and digital asset topics targeted for the public sector audience throughout the Asia-Pacific Region.

Mr. Peter Wright, Second Secretary at the Embassy of Canada to the Philippines, gave opening remarks, during which he highlighted the importance of training on anti-cryptocurrency laundering and its relevance to the region. He also reiterated the importance of building the capacity of financial institutions across the Indo-Pacific region.

Following opening remarks and a brief introduction from Mr. Greg Kelly of CRDF Global, Chainalysis subject matter experts walked participants through a detailed session on the cryptocurrency space, including a summary of blockchain and cryptocurrency, and sessions on hashing, ledgers and mining and how each of these operate. They continued with a breakdown of popular digital assets such as Bitcoin, Ethereum, Tokens, and EFTs, which included an explanation of how these assets function, how they are different from each other, and what vulnerabilities these assets have to exploitation by illicit actors. Chainalysis experts also discussed risk typologies such as ransomware, crypto hacks, and scams. This was supplemented by case studies on these risk typologies. For the final session of the day, the Chainalysis team explained crypto exposure (direct and indirect) and concluded with a case study highlighting the strategies used by illicit actors to launder money, which allowed participants to see how these malicious entities can circumvent sanctions and exploit vulnerabilities in the crypto space.

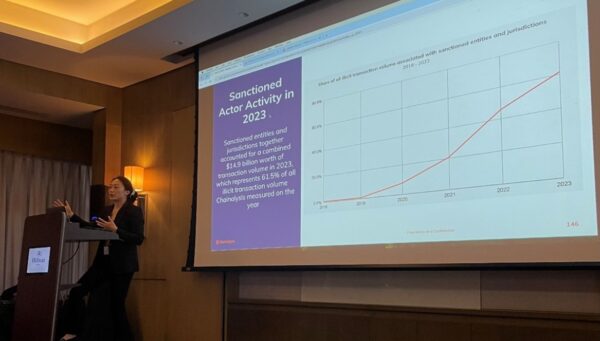

During the second day of training, the Chainalysis team covered the sectorial risks associated with digital assets. This segment included a detailed look at the status of international sanctions regimes, specifically the definition and description of FATF recommendation 15 and how this FATF recommendation relates to the participants’ institutions. The team then continued by taking a deep dive into the current legislative status of crypto-specific laws and regulations in the Indo-Pacific region, spotlighting which countries in the region are building robust cryptocurrency regulations and what jurisdictions could do more to safeguard their financial space. Chainalysis went further by providing an overview of the compliance challenges participants can face in the cryptocurrency space and detailed the fundamental elements in building a well-regulated crypto compliance program. This was supplemented by including a detailed list of the most sanctioned entities so that participants could better understand the specific threats they face in the digital asset space and better protect themselves from these malicious actors. To finish the training, the Chainalysis team walked the participants through current cryptocurrency investigations, in which the trainers were able to use open-source tools to showcase how illicit actors can obfuscate digital assets and strengthen the participants ability to identify the various red flags and illicit activity present in the case studies.

SME Kelly Looman presenting “The Current Activities of Sanctioned Entities.”

Participants responded positively to the training, remarking that “The SMEs were highly knowledgeable in the field and did an excellent job in explaining the complexities of digital assets!” The expertise from Chainalysis, the interactive exercises, and many case studies were helpful to better equip participants to protect their jurisdictions from a growing number of cryptocurrency threats. Multiple participants stated that they would attend additional workshops that focus on the open-source research tools available and a more in-depth and interactive walkthrough of how this technology works in practice.

Hunter Harris is a Project Associate on the UN Sanctions Compliance team at CRDF Global.